Group Life Insurance

One of the benefits available to MainePERS members is the Group Life Insurance program. The program is available to State, teacher and those PLD employees whose employers have elected to participate in the program, and whose positions are eligible for coverage.

Program Guides

Frequently Asked Questions

Below are frequent Group Life Insurance questions. If you do not see an answer to your question below please contact the Survivor Services Unit.

How do I enroll?

The MainePERS Group Life Insurance program is available to State, teacher and those PLD employees whose employers have elected to participate in the program, and whose positions are eligible for coverage. If you complete an application for group life coverage within the first 31 days of becoming eligible, you may select coverage for yourself and your dependents without having to show evidence of insurability.

What coverage is available?

You may choose basic and supplemental coverage on yourself and dependent coverage for your eligible dependents. Basic coverage is equal to your annual gross compensation rounded up to the next one thousand dollars. Supplemental coverage is available at one, two or three times your basic coverage. Insurance on the employee also includes Accidental Death and Dismemberment coverage.

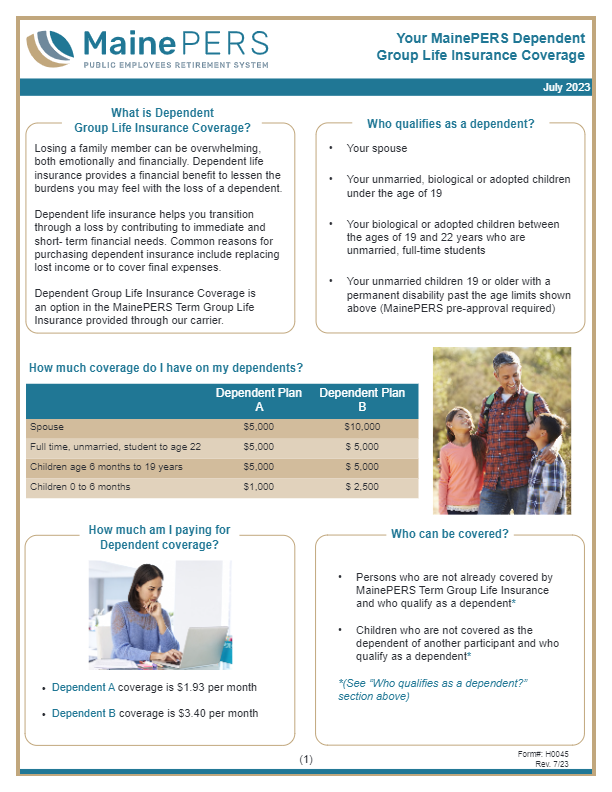

Dependent coverage allows you to choose up to $10,000 of coverage on your spouse and up to $5,000 on each child depending on their age and marital status.

How much does it cost?

The cost of coverage varies with employers. In some cases employers will pay for basic coverage while you pay for supplemental and dependent coverage. In other cases, you are responsible for all or part of your basic coverage plus any supplemental or dependent coverage you choose. For the cost of your coverage, please check with your employer’s payroll personnel.

Evidence of Insurability

When there is a request for basic and/or additional insurance that requires evidence of insurability, the member needs to complete Form# GI-0874. This form is used when an employee desires to increase their coverage or to obtain Dependent coverage.

This may also be as a result of late submission of their Application for Coverage when first eligible, or cancellation/reduction of previous coverage. Employers should not begin deducting premiums until approval has been received. The submission of a request for coverage does not guarantee acceptance. The process generally takes about 12 weeks to complete.

The MainePERS Survivor Services Unit will forward an Evidence of Insurability form for the employee to complete and submit to the insurance underwriter.

Any additional information required by the underwriter will be requested directly from the employee. If the employee does not respond in the time frame outlined by the carrier, the request will be cancelled due to lack of response. If the employee chooses to, they may begin the process again.

If the request for coverage is approved by the underwriter, coverage will take effect on the first day of the month following the date the employee completes one full month of additional service in an eligible class. The employer will receive information from the Survivor Services Unit indicating the level and effective date of coverage.

Active Work Rule: If the employee happens to be ill or injured and away from work on the date the coverage would take effect, the coverage will not take effect until the employee returns to work for one full regularly scheduled work day.

How can I obtain additional Group Life Insurance coverage?

A: If you wish to obtain or increase your coverage you must file Evidence of Insurability at your own expense and in accordance with the requirements of the insurance underwriter. The process begins by completing the form called Request for Basic and/or Additional Insurance Coverage Requiring Evidence of Insurability and sending it to the MainePERS. We will then send you a medical questionnaire which you will send to our insurance carrier. If approved, your coverage or increased coverage will become effective the first day of the month following the date you complete one month of additional service in an eligible class.

Can I change my Group Life insurance beneficiary?

You may change your life insurance beneficiary at any time and as often as you wish. Designation of Beneficiary – Group Life Insurance forms may be obtained from your payroll personnel, by contacting MainePERS or you may download them from the links below. In order for a change of beneficiary form to be valid, it must be received at MainePERS or postmarked prior to your date of death.

Designation of Beneficiary – Group Life Insurance (GI-0912)

Pension Beneficiary Designation for Pre-Retirement Death Benefits (CL-0722)

What happens if I do not name a beneficiary?

A: If you die without naming a beneficiary, or filing your designation, payment will be made in accordance with MainePERS law which provides a list of mandated beneficiaries in order of priority. The proceeds will pass first to your spouse. If you have no spouse or your spouse is also deceased, payment would be made to the duly appointed executor or conservator of your estate. Second, payment will be made to your child or children or to their descendents. If there is no child or descendents of a child, payment will be made to your parent(s).

Is there a cash value to my Group Life Insurance?

A: No. The group life insurance coverage offered by the MainePERS is term life insurance which has no cash surrender value.

What happens to my Group Life Insurance if I terminate my employment?

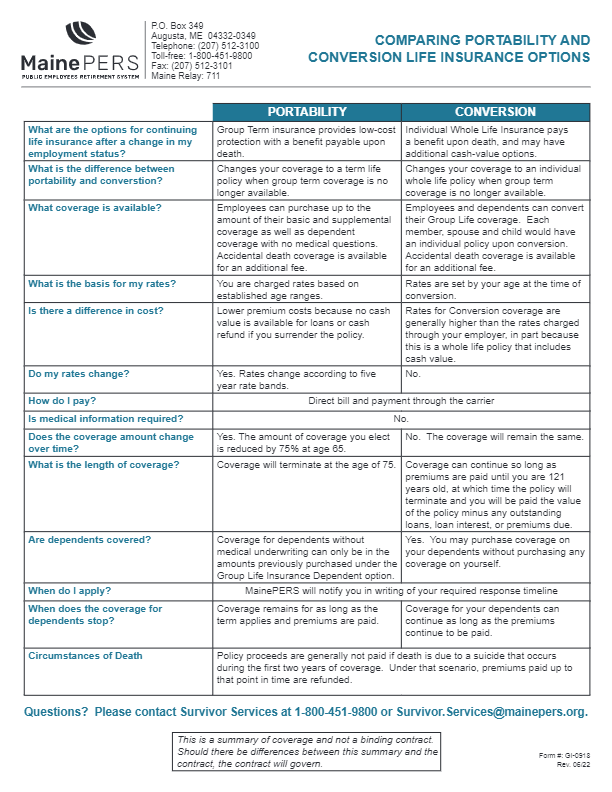

A: If you are terminating employment for purposes other than retirement, you will be offered the opportunity to continue your coverage by converting to a whole life policy or port your coverage to another group plan with MainePERS’ insurance carrier without proof of insurability. Conversion and portability are available to you for 31 days after your termination, after which your coverage ceases if you have not converted or ported your coverage.

What happens to my Group Life Insurance if I go on a leave of absence?

A: If you are on an approved leave of absence or seasonal layoff, you may continue to have coverage by continuing to pay your premiums. Talk with your payroll personnel or contact the MainePERS Survivor Services Unit to find out what steps you need to take to continue your payments. Failure to keep your premiums current will automatically result in the cancellation of your life insurance coverage.

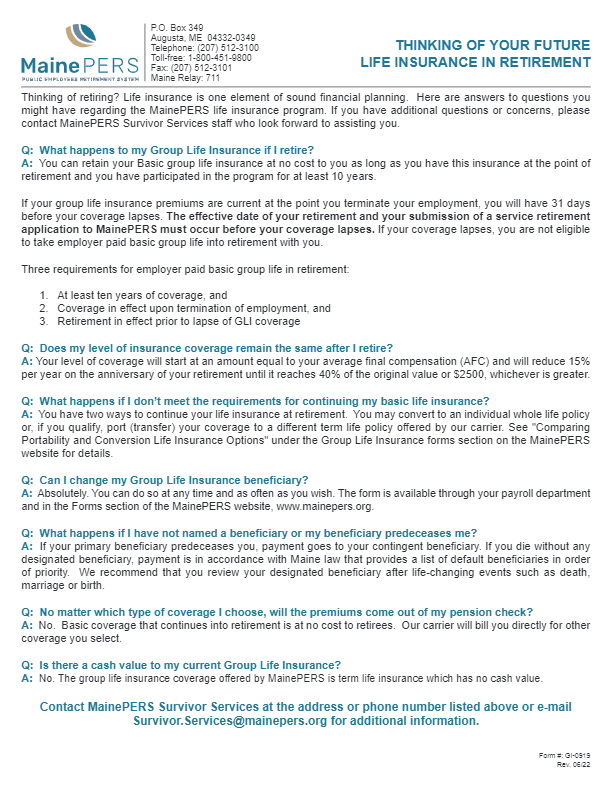

What happens to my group life insurance if I retire?

A: If you have group life insurance coverage just prior to retiring and have participated in the Group Life Program for 10 years, you may take your basic coverage into retirement at no cost to you. To take advantage of this coverage in retirement, you must submit your Application for Retirement no later than 31 days after your termination from employment and you must have a retirement date within the same period of time.

What happens to my Group Life Insurance if I receive disability benefits?

A: Your Basic coverage can be taken into disability retirement, provided you have coverage on the day you apply for disability or on the effective date of your approved disability. Any supplemental insurance you may have continues to be available only by conversion with our insurance carrier.

Does my level of insurance coverage remain the same after I retire? For State, Teacher, PLD, and Legislative members:

A: Your level of coverage will start at an amount equal to your average final compensation (AFC) at retirement and will reduce 15% per year on the anniversary of your retirement until it reaches 40% of the original value or $2500, whichever is greater.

EXAMPLE: Three highest years Average (AFC) of $28,000, Retirement Date of July 1, 2005.

| FROM | THROUGH | AMOUNT |

|---|---|---|

| 7/1/2005 | 6/30/2006 | $28,000 (full overage) |

| 7/1/2006 | 6/30/2007 | $23,800 (85% of $28,000) |

| 7/1/2007 | 6/30/2008 | $19,600 (70% of $28,000) |

| 7/1/2008 | 6/30/2009 | $15,400 (55% of $28,000) |

| 7/1/2009 | thereafter | $11,200 (40% of $28,000) |

Contact the Survivor Services Unit

If you have a question that is not addressed here, or if you need more information than provided here, please contact the Survivor Services Unit. We’re here to assist you with any questions regarding your group life coverage as a MainePERS member. Contact us by any of the following methods:

Mailing Address: P.O. Box 349, Augusta, ME 04332-0349

Phone: (207) 512-3244 (800) 451-9800

Fax: (207) 512-3101

E-mail: [email protected]